Arrowpoint Advisory’s Global Acquirer Trends Report, 2022

2022: A Year of Two Halves

Many M&A market participants entered 2022 with the benefit of significant momentum from a 2021 which had set all kinds of records in terms of deal activity across a broad spectrum of sectors, in part driven by a wave of post-covid consumer exuberance.

Despite this rather euphoric start to the year, it was also evident to anyone that stopped and looked around that a growing number of dark clouds had been gathering on the horizon, also in part due to the rapid pace of the post-covid recovery leading to an overheating of the global economy. Inflation, supply chain disruption, full employment, a hobbled Chinese economy and the inevitable hangover associated with governments’ aggressive fiscal support for households and businesses during covid were all manifesting themselves as potential threats.

Despite this, the first six months of 2022 were surprisingly busy, the collateral damage of Russia’s invasion of Ukraine in March 2022 only becoming completely apparent some months after the event. This conflict acted both to compound the structural threats high-lighted above and to act as a catalyst for the M&A and public markets to re-assess the overall outlook for investment. If investment bankers left for their summer holidays with a sense of trepidation about the remainder of 2022, they returned in September to a fearful and becalmed M&A market where participants had little motivation to chase down new opportunities

The UK market was particularly hard hit in Q4 2022 due to the additional impact on business and investor confidence prompted by Boris Johnson’s demise and 49 days of the Liz Truss administration, which caused serious issues in government borrowing costs and the wider bond markets. Fortunately, stability returned with a further change in chancellor and prime minister but not before shutting down the UK’s M&A and debt capital markets for the remainder of 2022.

2022: M&A Analysis

Global deal volumes for the whole 12-month period were ahead of 2021 but with the balance skewed to H1. Deal volumes increased in both developing markets and also across continental Europe. Overall deal volumes in the UK & Ireland fell 2.6% from a 2021 peak of 2,430 to 2,367 transactions, however the impact was asymmetrical across different sectors, reflecting the fact certain industries benefitted from rising energy costs, while many more suffered, and a collapse in consumer confidence hit discretionary spending.

While specialist distributers were able to exercise some pricing strength and overall business services transactions grew by almost 10%, a lot of consumer businesses came under considerable pressure from energy prices and wage and food inflation. This resulted in both increased business failures and a decline in deal volumes of over 7%. With some of the affected Consumer businesses still in intensive care following covid, it was sad but not surprising to see a growing cohort of retailers and restaurant chains hit the wall in Q4 2022.

UK manufacturers also had a tough end to the year, with rising energy prices compounding significant ongoing issues in their international supply chains corroding margins and their appetite to invest. Industrial sector deals volumes were the hardest hit of any sector, with transaction numbers falling almost 20% compared with the prior year.

Despite fewer specific trading headwinds, increased cost of capital and reduced market valuations also saw deal activity soften in the media and technology sector with UK&I transaction volumes falling by over 7%.

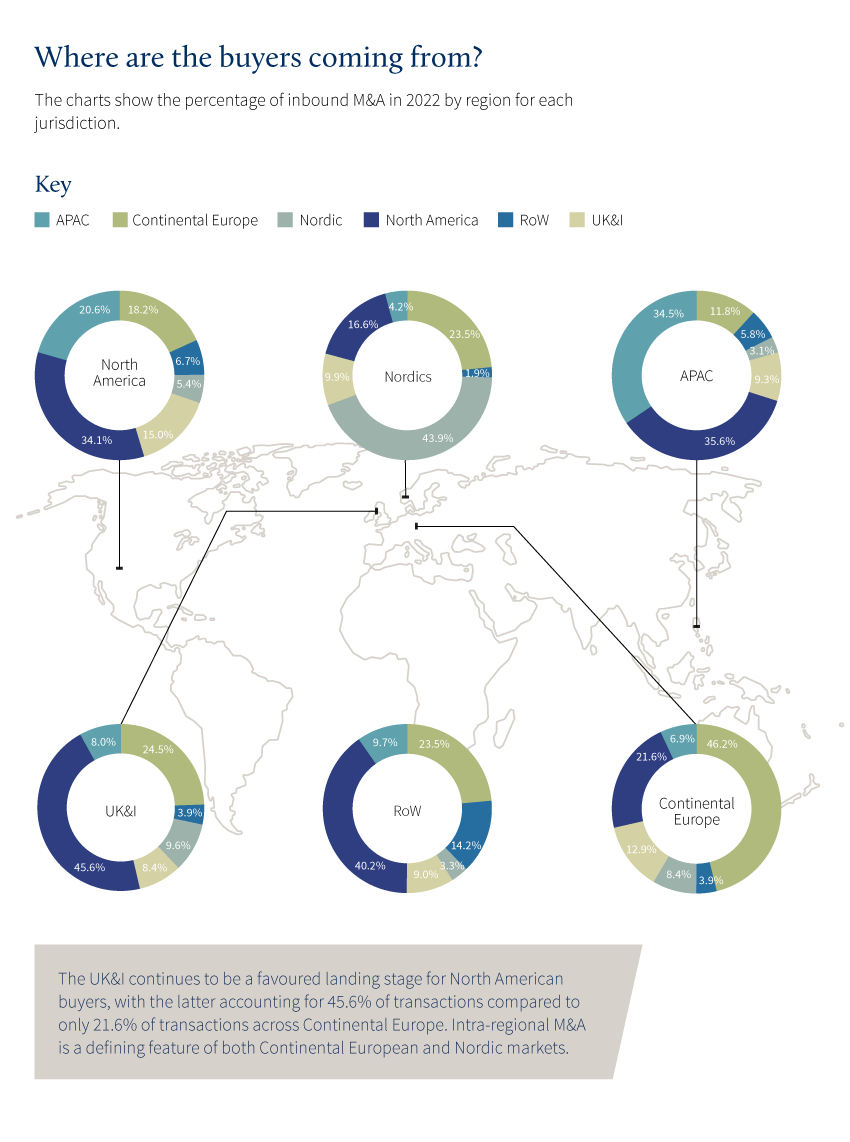

Interestingly, while domestic deal activity was down over 9% from 2021, the volume of inbound investments into the UK increased by over 4%. This disparity may be attributed to a range of factors from the relative cost of capital for domestic and international buyers, to opportunistic M&A driven by the effect of a weak sterling currency on relative valuations of UK assets, to simple overall confidence in global economic growth.

While deal volumes fluctuate it would be of greater concern if this relative nervousness around investing for growth is being reflected in comparative capital and NPD investment in the UK versus other markets. And yet, even here, the data suggests that appetite for acquisition and investment in the UK remains much stronger than is suggested by mainstream press coverage of the economy.

Against this tumultuous background, our team continues to be active across all of our M&A sectors as well as in our broader financing activities. I hope you find this data of value and we look forward to working with you in the coming months.